|

|

| Page 1 of 1 |

|

|

Posted: Wed, 10th Apr 2013 12:18 Post subject: How Hollywood Accounting Can Make a $450 Million Movie LOSS Posted: Wed, 10th Apr 2013 12:18 Post subject: How Hollywood Accounting Can Make a $450 Million Movie LOSS |

|

|

| Quote: |

How Hollywood Accounting Can Make a $450 Million Movie 'Unprofitable'

Here is an amazing glimpse into the dark side of the force that is Hollywood economics. The actor who played Darth Vader still has not received residuals from the 1983 film "Return of the Jedi" because the movie, which ranks 15th in U.S. box office history, still has no technical profits to distribute.

How can a movie that grossed $475 million on a $32 million budget not turn a profit? It comes down to Tinseltown accounting. As Planet Money explained in an interview with Edward Jay Epstein in 2010, studios typically set up a separate "corporation" for each movie they produce. Like any company, it calculates profits by subtracting expenses from revenues. Erase any possible profit, the studio charges this "movie corporation" a big fee that overshadows the film's revenue. For accounting purposes, the movie is a money "loser" and there are no profits to distribute.

Confused? Imagine you're running a lemonade stand with your buddy Steve. Your mom says you have to share half your profits with your sister. But you don't wanna! So you pretend your buddy Steve is actually a corporation -- call him Steve, Inc -- charging you rent for the stand, the spoon, etc. "Dang, mom, I don't have any profits, I had to pay it all to Steve, Inc!" you say when you come home. But the money isn't gone. It's as good as yours -- in your best friend's pocket.

So: "Return of the Jedi" is a $475 million lemonade stand.

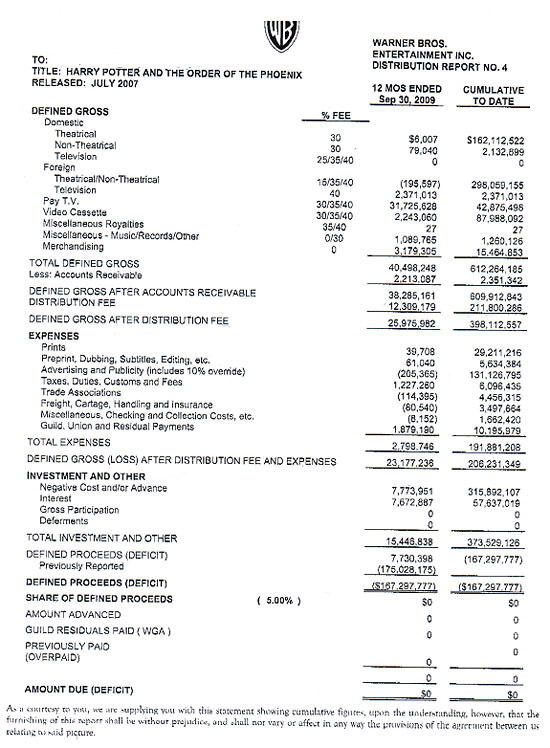

Hollywood can't really work like this, you're thinking. But it does. Last year, the website Techdirt revealed a balance sheet from "Harry Potter and the Order of the Phoenix", which, under Hollywood accounting, ended up with a $167 million "loss" even though it's one of the top grossing films of the last decade. Warner Bros. charged about $350 million in distribution, advertising, and interest fees to this external corporation. Here's the receipt.

This brings us back to Darth. "Return of the Jedi" made almost half a billion dollars. But Return of the Jedi, Inc, still has no profit to pay its famous villain because the movie corp has paid so much of its revenue back to the studio in distribution fees. Here's actor David Prowse, via Techdirt:

"I get these occasional letters from Lucasfilm saying that we regret to inform you that as Return of the Jedi has never gone into profit, we've got nothing to send you. Now here we're talking about one of the biggest releases of all time," said Prowse. "I don't want to look like I'm bitching about it," he said, "but on the other hand, if there's a pot of gold somewhere that I ought to be having a share of, I would like to see it."

Most corporations try to make a profit by limiting costs. Movies corporations manage to record a loss by maximizing costs. Only in Hollywood, indeed. |

sause: http://www.theatlantic.com/business/archive/2011/09/how-hollywood-accounting-can-make-a-450-million-movie-unprofitable/245134/

| Lutzifer wrote: | | and yes, mine is only average |

|

|

| Back to top |

|

|

|

|

Posted: Wed, 10th Apr 2013 12:42 Post subject: Posted: Wed, 10th Apr 2013 12:42 Post subject: |

|

|

|

|

|

| Back to top |

|

|

|

|

Posted: Wed, 10th Apr 2013 12:44 Post subject: Posted: Wed, 10th Apr 2013 12:44 Post subject: |

|

|

OMG YOU R STEALIN FROM US BY DOWNLOADING OUR MOVIEHZ!!!

| Lutzifer wrote: | | and yes, mine is only average |

|

|

| Back to top |

|

|

Moshi

Posts: 346

Location: Slovenia

|

Posted: Wed, 10th Apr 2013 12:53 Post subject: Posted: Wed, 10th Apr 2013 12:53 Post subject: |

|

|

|

|

|

| Back to top |

|

|

|

|

Posted: Wed, 10th Apr 2013 13:15 Post subject: Posted: Wed, 10th Apr 2013 13:15 Post subject: |

|

|

| PumpAction wrote: | | Wankers and thieves. |

Ryzen 5 5600, ASUS ROG STRIX B550-F GAMING WIFI II, Corsair Vengeance RGB RT 32GB 3600MHz C16, MSI RTX 5070 Ti Ventus 3X OC , Corsair RMx Series RM750x. AOC AGON AG324UX - 4K 144Hz 1ms

|

|

| Back to top |

|

|

spankie

VIP Member

Posts: 2958

Location: Belgium

|

Posted: Wed, 10th Apr 2013 13:57 Post subject: Posted: Wed, 10th Apr 2013 13:57 Post subject: |

|

|

Well duh, what would you do? But they do forget that the other corporation will be taxed. In the lemonade stand example, Steve Inc will be taxed.

The 350 million that went to Warner Bros did appear in the accounting books. If WB made a 350million profit, the 350 million would be taxed. Too bad for the guy, but it just looks like he got screwed with the contract he signed.

All companies do it, it is just optimization. Google Europe is registered in Ireland and all the local Googles earn money but pay a lot of 'license premiums' to be allowed to operate. Result? The local Googles earn no profit, Google Ireland earns a lot. Guess where corporate tax is the lowest? Ireland

|

|

| Back to top |

|

|

Morphineus

VIP Member

Posts: 24883

Location: Sweden

|

Posted: Wed, 10th Apr 2013 14:06 Post subject: Posted: Wed, 10th Apr 2013 14:06 Post subject: |

|

|

And this kind of optimization should go out of this world

We always need to clean up after businesses even though they had years of profits, then a crisis comes up and they need help. Did they invest in their company? Just a fraction. It always sticks to the 5%.

But this will be around for as long as people are around. Still can't justify people earning 10x more than the lowest wage and usually it's a greater multiplier than 10.

Then again I make no illusions that the tax money is spend better tho. It's there to keep a majority of clueless people around

|

|

| Back to top |

|

|

|

|

Posted: Wed, 10th Apr 2013 15:09 Post subject: Posted: Wed, 10th Apr 2013 15:09 Post subject: |

|

|

wich actor played Vader are the refferin too?

vader had

Earl - voice

David Prowse - Body

Sebastian Shaw - face

3 different actors for the same character.

| Sin317 wrote: | | while you can't "turn gay", you can cut off your balls. believe me, you'll never think of women again. |

| zmed wrote: | | Or just a defense mechanism. If you fart, you'll most definitely smell it so your brain tells you it ain't bad as strangerfarts. |

|

|

| Back to top |

|

|

Sin317

Banned

Posts: 24321

Location: Geneva

|

Posted: Wed, 10th Apr 2013 15:11 Post subject: Posted: Wed, 10th Apr 2013 15:11 Post subject: |

|

|

| speedgear wrote: | wich actor played Vader are the refferin too?

vader had

Earl - voice

David Prowse - Body

Sebastian Shaw - face

3 different actors for the same character. |

guess you didn't read.

|

|

| Back to top |

|

|

zipfero

Posts: 8938

Location: White Shaft

|

Posted: Wed, 10th Apr 2013 15:11 Post subject: Posted: Wed, 10th Apr 2013 15:11 Post subject: |

|

|

| spankie wrote: | Well duh, what would you do? But they do forget that the other corporation will be taxed. In the lemonade stand example, Steve Inc will be taxed.

The 350 million that went to Warner Bros did appear in the accounting books. If WB made a 350million profit, the 350 million would be taxed. Too bad for the guy, but it just looks like he got screwed with the contract he signed.

All companies do it, it is just optimization. Google Europe is registered in Ireland and all the local Googles earn money but pay a lot of 'license premiums' to be allowed to operate. Result? The local Googles earn no profit, Google Ireland earns a lot. Guess where corporate tax is the lowest? Ireland |

All of this is known and doesnt make it less douchy. Nestlé has yet to pay taxes in our country in a place where they revenue like 4 billion DKK every year.

|

|

| Back to top |

|

|

|

|

Posted: Wed, 10th Apr 2013 15:46 Post subject: Posted: Wed, 10th Apr 2013 15:46 Post subject: |

|

|

| spankie wrote: | Well duh, what would you do? But they do forget that the other corporation will be taxed. In the lemonade stand example, Steve Inc will be taxed.

The 350 million that went to Warner Bros did appear in the accounting books. If WB made a 350million profit, the 350 million would be taxed. Too bad for the guy, but it just looks like he got screwed with the contract he signed.

All companies do it, it is just optimization. Google Europe is registered in Ireland and all the local Googles earn money but pay a lot of 'license premiums' to be allowed to operate. Result? The local Googles earn no profit, Google Ireland earns a lot. Guess where corporate tax is the lowest? Ireland |

im in finance already for more than 10 years... the warner bros company indeed will have a profit in its books which will be offset with a management fee received from an offshore company located in a tax haven. all multinationals have its ultimate beneficiary (company) located in a tax haven... it's the biggest scam ever. the recent leaks tried to open the discussion but there is and will never be an official forum to discuss it.

the phenomenon of creating a diarrhea of legal entities/companies is called tax structuring (what's in the name) - it's only goal is realizing untransparent flows among all entities to avoid correct transfer pricing audits as tax authorities only work on country level.... all profits are piled up where there is no tax on earnings/income. nothing advanced about if... pure fraud

|

|

| Back to top |

|

|

| Page 1 of 1 |

All times are GMT + 1 Hour |

|

You cannot post new topics in this forum

You cannot reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

|

Powered by phpBB 2.0.8 © 2001, 2002 phpBB Group

|

|

|

|